|

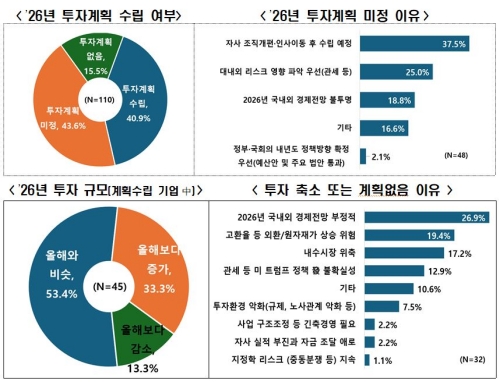

| A survey by the Korea Enterprises Federation (KEF) shows that 6 out of 10 of Korea’s top 500 companies have not finalized or do not have investment plans for 2026. The chart shows corporate responses regarding next year’s investment planning status. / Source: KEF |

Amid growing uncertainty in domestic and global business conditions, nearly 60% of major Korean companies say they have no investment plans for next year or have yet to finalize them, according to a new survey.

The Korea Enterprises Federation (KEF) said on December 7 that it surveyed the nation’s top 500 companies by revenue, with 110 firms responding. Of these, 59.1% said they had not yet drawn up investment plans for 2026 (43.6%) or had no plans at all (15.5%). Only 40.9% said plans were in place. KEF attributed the caution to rising corporate tax burdens, proposed changes to labor laws, and discussions on extending the retirement age, all of which it said have constrained companies’ capacity to invest.

Among firms that have established investment plans, 53.4% said next year’s spending would be similar to this year’s. Companies that have not finalized their plans cited organizational restructuring and personnel changes (37.5%), the need to assess domestic and global risks first (25.0%), and uncertainty about next year’s economic outlook (18.8%).

Of the total respondents, 33.3% said they would reduce investment compared with this year, while 13.3% planned to increase it. Firms planning cuts or no investment pointed to pessimistic economic forecasts for 2026 (26.9%) and risks from high exchange rates and rising raw material prices (19.4%). Companies planning to expand investment cited the need to seize opportunities in future industries and strengthen competitiveness (38.9%), as well as to replace or improve aging facilities (22.2%).

Firms identified the expansion of protectionist trade measures and deepening supply chain instability (23.7%), slowing economies in major countries including the United States and China (22.5%), and high exchange rates (15.2%) as the biggest investment risks heading into 2026.

Lee Sang-ho, head of KEF’s Economic and Industrial Division, said instability in supply chains, currency volatility and regulatory burdens were weighing on corporate investment. He called for “efforts to stabilize the exchange rate, expand tax incentives for advanced industries, and improve regulations to reinvigorate domestic investment.”

#corporate investment slowdown #KEF survey #economic uncertainty 2026 #protectionism and supply chains #high exchange rate risks

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7