|

AsiaToday reporter Jeong Geum-min

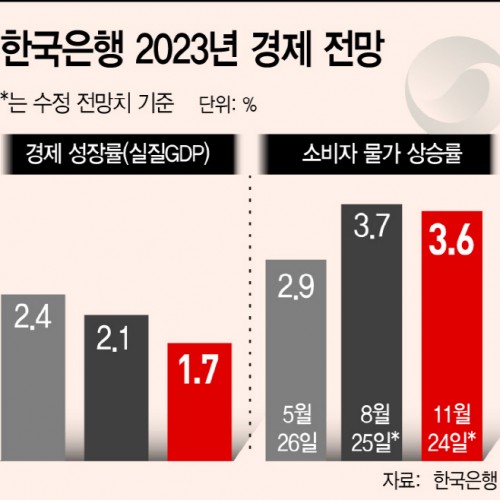

As South Korea continues to face the complex crisis of high interest rates, high inflation and high exchange rates, the prospects for the Korean economy for next year remains gloomy. The country’s central bank, the Bank of Korea (BOK), lowered its 2023 growth outlook Thursday to 1.7 percent from 2.1 percent predicted three months earlier. The country’s annual growth previously fell short of reaching the 2 percent range only during periods of crises – 0.8 percent in 2009 during the global financial crisis and minus 5.1 percent in 1998 in the midst of the Asian financial crisis.

The BOK revised down its 2023 growth outlook for next year to 1.7 percent, slower than its August forecast of 2.1 percent. The central bank held a meeting of the monetary policy board and decided to lift the benchmark seven-day repurchase rate by 25 basis points to 3.25 percent. It marked the sixth straight interest hike, raising the base rate to its highest level in 11 years since June 2011.

BOK Governor Rhee Chang-yong told the press, “Exports of both IT (information technology) and non-IT items will turn to a downward trend next year due to weakening global demand and falling unit prices.” He said the South Korean economic growth is forecast to remain below its growth potential due to sluggish growth in major economies, adding that the United States, China and Japan will grow at slower paces.

The BOK plans to continue raising the base rate in consideration of the high inflation rate. The consumer inflation index of Korea rose to 109.21, a 5.7 percent rise from the previous year, while the expected inflation rate has maintained at the 4 percent level for the fifth month. Consumer price inflation is estimated at 5.1 percent in 2022 and 3.6 percent in 2023. But in 2014, it was predicted to be 2.5 percent, exceeding the target of 2 percent.

The monetary policy board judges that the policy response to ensure price stability should be continued, as inflation has remained high. “We will check the growth trend going forward and ensure that the inflation rate is stable at the target level in the mid-term,” the BOK said in a statement.

Some analysts say that the economic slump can gradually ease after the second half of next year as external uncertainties diminish. The BOK projected a 2.3 percent growth for 2024, exceeding the potential growth rate.

#Bank of Korea #Rhee Chang-yong #growth projection #economy #outlook

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7