|

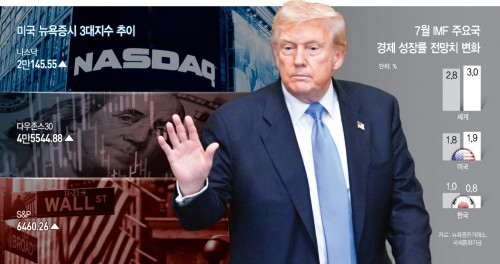

| Former U.S. President Donald Trump delivers remarks on tax reform at the White House in Washington. / Source: Yonhap News |

U.S. President Donald Trump’s second-term economic agenda—centered on sweeping tax cuts and deregulation—is gaining traction, raising optimism among Korean companies eyeing investment and growth opportunities in the American market.

Since Trump’s inauguration in January, U.S. economic indicators have defied early skepticism. Inflation, measured by the Consumer Price Index, has remained in the 2% range for five straight months, while the job market has held steady with unemployment hovering between 4.0% and 4.2%. This resilience has fueled renewed focus on “Trumponomics,” with analysts highlighting the dual pillars of tax relief and regulatory rollbacks.

The Korean government, which shares Washington’s approach to expanding fiscal spending, has yet to signal a clear stance on corporate tax reductions or deregulation. As a result, observers suggest Trump’s pro-business climate may attract more Korean firms to expand operations in the United States.

At the core of Trumponomics is the “One Big Beautiful Bill Act” (OBBBA), which makes permanent the 2017 tax reforms. The law extends corporate and individual income tax cuts, doubling inheritance and gift tax exemptions, and allowing immediate expensing of R&D and capital investments. Analysts estimate the act will deliver a staggering $4.5 trillion in tax savings over the next decade, supporting both consumer spending and corporate expansion.

For corporations, the retention of the 21% corporate tax rate and the ability to expense major investments upfront are expected to accelerate AI-related infrastructure projects, including data centers. Wall Street has responded with record stock gains, reflecting investors’ anticipation of stronger cash flows.

The Wall Street Journal reported that S&P 500 companies could see collective tax savings of $148 billion in 2025 alone, equivalent to 8.5% of their projected free cash flow. Verizon, for example, expects to slash its corporate tax bill by up to $2.8 billion compared to last year. Energy firms like Diamondback Energy and tech contractors such as Leidos are also forecast to benefit significantly.

Beyond the private sector, OBBBA allocates funds for defense modernization and infrastructure, including $150 billion for military upgrades and $165 billion for border security. This spending is opening the door for startups in AI, satellite, and sensor technologies to secure major government contracts.

Trump’s economic vision stands in sharp contrast to his predecessor Joe Biden’s “Bidenomics,” which proposed raising taxes on corporations and the wealthy to fund social programs. While Biden’s bottom-up strategy failed to pass, Trump’s trickle-down approach is now reshaping the U.S. investment landscape.

Still, the Congressional Budget Office has warned that the sweeping tax cuts could add more than $2.4 trillion to federal debt, a risk that could weigh on long-term growth. For now, however, Trump’s pro-business policies are driving confidence—especially among Korean firms that see the U.S. as both a stable market and a springboard for next-generation industries.

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7