Naver cafés foster ex-convicts since lending names for bank accounts is subject to criminal prosecution. Naver must block harmful information.

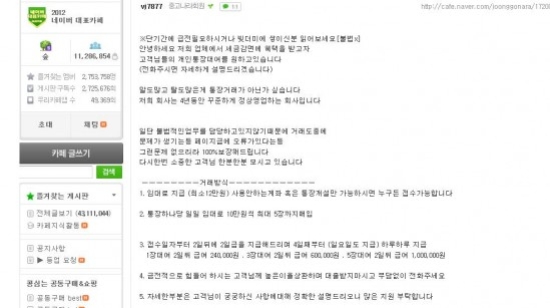

Naver's café 'Joonggonara' shows many advertisements tempting viewers sell their names in return for 240,000 won. |

Jung, a 20 year-old student living in Incheon, recently read a post offering a 'bank account' part-time job uploaded on one of Naver cafés'. After lending his bank account, he received a call from a police officer accusing him of committing fraud.

Jung's bank account turned into a borrowed-name bank account used for financial crimes. Jung failed to contact the recruiter he called for a part time job. Eventually, he had to be investigated on suspicion of aiding the fraud.

It was found that many of Naver cafés like 'Joonggonara' are becoming hotbed of crime despite the continuous comments from media outlets. Experts say that Naver should have a strong filtering system to prevent crime and victimization.

On September 10, AsiaToday investigated several Naver cafés and found hundreds of posts offering a 'bank account' part time job. Those cafes provide cell phone numbers and a catchy phrase saying that they will give you money just for borrowing your bank account. When you call to the phone number, they tell you that they are either social enterprise or capital company and they are borrowing accounts because of tax problems. They tell you that it's 100% safe and may give you 5,000,000 to 6,000,000 won for borrowing for three months.

Many think that lending a bank account is not illegal, however, illicit lending is subject to financial transaction restriction and criminal prosecution.

Under current law, those who lend their names as well as those who open accounts can be sent to jail for 3 years or fined up to 20 million won.

According to the Financial Supervisory Service (FSS), more than 40,000 borrowed-name accounts are currently circulating in the financial market. From October 2011 to the first half of 2013, nearly 87,000 bank accounts were used in financial crimes and 36,000 newly-opened accounts, which is 64 percent of total newly-opened accounts, were used for phishing.

The FSS says that they constantly monitor illegal ads online to prevent illicit buying and selling personal credit information and bank accounts but it won't be enough if major portals like Naver don't regulate by themselves.

#naver #Joonggonara #borrowed name account #fraud

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7