|

South Korea’s stock market has soared in the three weeks since President Lee Jae-myung took office, with the KOSPI’s total market capitalization increasing by over 300 trillion won and foreign investors injecting more than 120 trillion won. While the rally reflects optimism about political stability and pro-market reforms, experts are warning that the sudden surge may be forming a bubble.

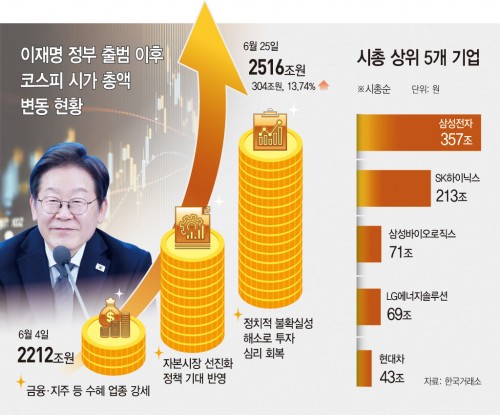

According to the Korea Exchange on June 26, the total KOSPI market cap reached 2,516.05 trillion won, up from 2,211.66 trillion won on June 2—the day before Lee’s inauguration—marking a 304 trillion won increase. The combined market cap of the top 10 listed firms alone rose by over 105 trillion won during the same period.

The top 10 companies by market cap now include Samsung Electronics (357 trillion won), SK Hynix (213 trillion), Samsung Biologics (71 trillion), LG Energy Solution (69 trillion), Hyundai Motor (43 trillion), KB Financial Group (42 trillion), Hanwha Aerospace (42 trillion), Doosan Enerbility (41 trillion), Naver (41 trillion), and Samsung Electronics preferred shares (41 trillion).

SK Hynix’s surge has been fueled by growing demand for AI semiconductors, while Samsung Electronics is benefiting from expectations of a semiconductor recovery. Hyundai Motor is attracting attention with its focus on electric and hydrogen vehicles.

The rally is largely attributed to the resolution of political uncertainty following the change in government and rising expectations for capital market reforms. The Lee administration has proposed bold measures, including amending the Commercial Act, strengthening shareholder rights, creating a Korean-style SEC, and expanding share buybacks and cancellations—all of which have fueled investor optimism.

Foreign investors have played a major role in the upswing. From June 2 to June 26, foreign ownership of KOSPI stocks rose by nearly 120 trillion won to 822 trillion won, with their market share rising from 31.72% to 32.62%. Foreigners accounted for roughly 40% of the overall market cap increase.

Compared to previous administrations, the magnitude of the current rally is exceptional. During the first 22 trading days of the Moon Jae-in government in 2017, the KOSPI rose 2.26%, and under Yoon Suk Yeol in 2022, it rose just 0.55%. In contrast, the KOSPI has surged over 14% under Lee, jumping from 2,698.97 to 3,076.81 and breaking past the 3,000 mark for the first time in three and a half years.

However, experts caution that the rise is driven more by sentiment than fundamentals, and warn of potential market corrections.

“The recent surge in market cap is largely driven by foreign capital inflows amid reduced political risk,” said Yang Jun-seok, economics professor at the Catholic University of Korea. “While some of it reflects recovery from last year’s losses, excessive asset inflation based on policy optimism could ignite speculative behavior and result in a bubble.”

Jeon Seong-in, economics professor at Hongik University, echoed those concerns. “While market reform expectations have played a role, a large portion of the recent gains could be speculative,” he said. “Without solid fundamentals, sharp increases tend to be corrected over time.”

He added, “If the government focuses only on short-term market gains, the long-term burden may ultimately fall on investors.”

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7