|

| People walk along Myeongdong shopping street in central Seoul. The Korea Development Institute (KDI) raised its 2026 growth forecast, citing signs of gradual recovery in domestic demand. / Source: Yonhap News |

South Korea’s economic growth outlook for 2026 is brightening, with major state and financial research institutes projecting growth close to the 2% range, supported by a gradual recovery in domestic demand.

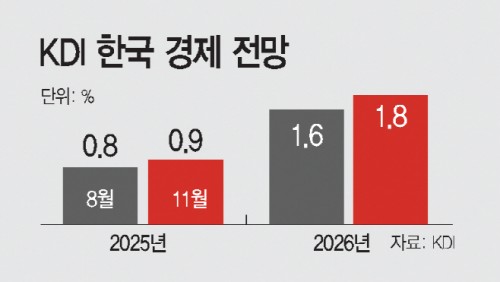

The Korea Development Institute (KDI) raised its 2026 GDP growth forecast from 1.6% to 1.8%, while the Korea Institute of Finance (KIF) predicted a stronger rebound of 2.1%. Both cited improving domestic consumption and investment conditions as key drivers.

In its “2025 Second Half Economic Outlook” released Tuesday, KDI said the economy is expected to grow 1.8% next year, up 0.2 percentage points from its August projection. The figure aligns with estimates from both the government and the International Monetary Fund (IMF), which also project 1.8% growth.

|

"Exports will likely slow, but domestic demand is expected to recover, resulting in overall growth of about 1.8%,” said Jung Kyu-chul, head of KDI’s Economic Outlook Office.

According to KDI, private consumption will rise 1.6% in 2026, up from 1.3% this year, helped by lower interest rates and expansionary fiscal policy. Facility investment, buoyed by strong semiconductor spending, will continue to post 2% growth, while construction investment is forecast to rebound 2.2%, recovering from this year’s sharp 9.1% contraction.

However, exports are projected to slow to 1.3% growth, compared with 4.1% this year, due largely to higher U.S. tariffs.

KDI also slightly upgraded this year’s growth estimate from 0.8% to 0.9%, noting that the economy expanded 1.2% year-on-year in the third quarter, signaling a modest but steady improvement.

The Korea Institute of Finance offered a similarly optimistic view. At its “2026 Economic and Financial Outlook Seminar” on Tuesday, the institute forecasted 2.1% growth next year, citing loose financial conditions and increased government spending.

“Private and public consumption are expected to recover together, with construction investment rebounding slightly due to base effects and facility investment rising moderately,” said Kim Hyun-tae, head of the KIF’s Macroeconomic Research Division.

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7