|

Major global investment banks (IBs) and Korean securities firms are revising their 2026 economic growth forecasts for South Korea upward, citing sustained momentum in semiconductor exports. Many projections now exceed the Bank of Korea’s own estimate.

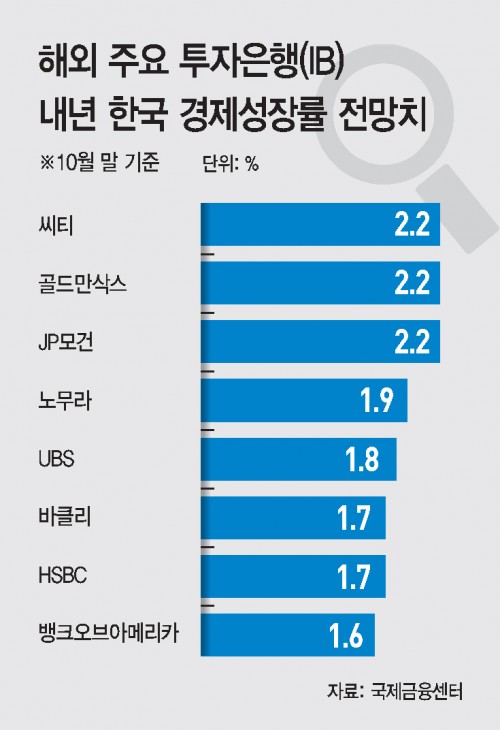

According to the Korea Center for International Finance on November 6, eight major foreign IBs expect South Korea’s real gross domestic product (GDP) to grow by an average of 1.9% next year, up 0.1 percentage point from the end of September. Seven of the eight forecasts surpass the Bank of Korea’s August projection of 1.6%.

Citigroup sharply raised its forecast from 1.6% to 2.2%, while JPMorgan and Goldman Sachs also predict 2.2% growth. Other forecasts include Nomura (1.9%), UBS (1.8%), Barclays (1.7%), and HSBC (1.7%).

The upgrade reflects expectations of continued export strength next year, especially in semiconductors and automobiles. From January to September, exports totaled $519.7 billion, up 2.2% from a year earlier, according to the Ministry of Trade, Industry and Energy. Semiconductor exports alone surged 16.9% to $119.7 billion, a record high.

The solid trade performance helped the current account surplus reach $82.77 billion, up 23% from the previous year. Analysts also say that the recent resolution of tariff negotiations with the United States has reduced uncertainty, brightening export prospects further.

Domestic securities firms share a similarly optimistic view. After South Korea’s third-quarter GDP growth of 1.2% exceeded market expectations, local analysts now project steady momentum through year-end. Samsung Securities raised its 2026 forecast from 2.0% to 2.2%, and Korea Investment & Securities from 1.8% to 1.9%.

“From the fourth quarter onward, Korea’s economy is expected to grow near its potential rate of around 1.8% annually,” wrote Jeong Sung-tae, an analyst at Samsung Securities, citing sustained semiconductor exports, easing trade uncertainties, potential U.S. interest rate cuts, and gradual recovery in private consumption and investment.

Choi Ji-wook of Korea Investment & Securities added that a “wealth effect” from stock market gains, possible supplementary budgets ahead of local elections, and rising chip demand will likely serve as upside factors for next year’s economy.

Earlier, the International Monetary Fund (IMF) also forecast Korea’s 2026 growth at 1.8%, signaling a recovery to its potential growth level. During the APEC Summit, IMF Managing Director Kristalina Georgieva told President Lee Jae-myung that “Korea’s economy is rebounding, as seen in recent indicators on consumption and exports,” adding that she expects the trend to continue into next year.

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7