|

As the KOSPI index soars past the 4,100 mark to reach an all-time high, analysts forecast that the semiconductor sector will take an even larger share of total corporate profits next year. The surge is being fueled by an ongoing wave of artificial intelligence (AI) investment that continues to expand global memory demand.

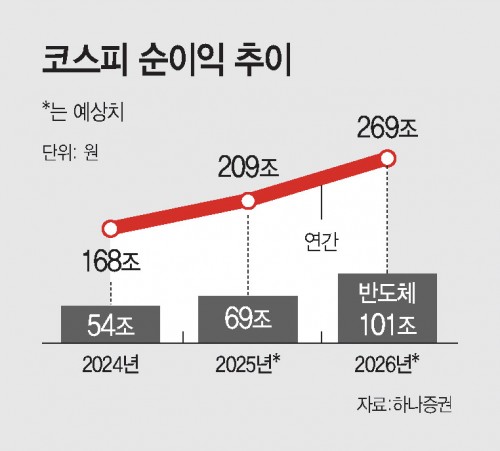

According to financial industry data on November 2, the combined net profit of KOSPI-listed companies is projected to rise 28 percent year-on-year to 269 trillion won in 2026, up from an estimated 209 trillion won this year and 168 trillion won last year—marking three consecutive years of profit growth.

The main growth driver remains semiconductors. The sector’s total net profit is expected to jump from 69 trillion won this year to more than 100 trillion won next year, led by industry leaders Samsung Electronics and SK Hynix. Both firms are enjoying record performance amid robust demand for high-bandwidth memory (HBM) and DRAM chips used in AI data centers.

As a result, the semiconductor industry’s share of total KOSPI net profit is projected to rise from 32.6 percent this year to 36.3 percent in 2026, while shipbuilding’s share is set to increase slightly from 2.93 to 3.38 percent.

Lee Jae-man, an analyst at Hana Securities, estimated that “the expected return for semiconductor stocks next year is 7.2 percent, compared to 6.6 percent for non-semiconductor sectors,” adding that “based on these figures, the KOSPI is likely to reach around 4,650 points in 2026.”

Semiconductor stocks were also the main engine behind last week’s KOSPI rally. Data from the Korea Exchange showed that retail investors placed more than 60,000 large orders—each exceeding 100 million won—for Samsung Electronics in October, driven by stronger-than-expected earnings and optimism over its chip supply deal with Nvidia.

Samsung Electronics’ third-quarter operating profit jumped 32.5 percent year-on-year to 12.17 trillion won, beating market expectations. SK Hynix also saw robust demand, with more than 43,800 large investor orders last month. Over the past week, Samsung and SK Hynix shares climbed 5.40 percent and 4.49 percent respectively, lifting the KOSPI from 4,042.83 to 4,107.50 points.

However, investor sentiment diverged: while domestic retail investors were net buyers, foreign investors took profits.

“The continued rise in chip prices may lead to upward revisions in profit-margin estimates for Korean semiconductor firms,” Lee added.

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7