|

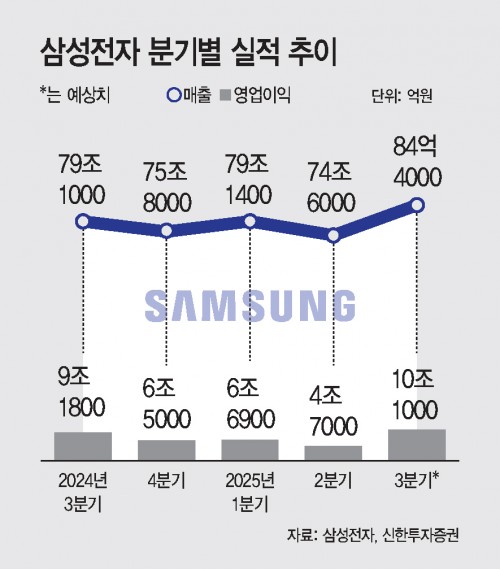

Samsung Electronics is expected to return to double-digit operating profit in the third quarter, buoyed by a rebound in semiconductors and solid Galaxy smartphone momentum. Market consensus points to operating profit surpassing 10 trillion won, after single-digit trillions earlier this year.

In the second quarter, Samsung’s operating profit lingered in the mid-4 trillion won range on weaker IT demand, soft memory prices and continued foundry losses—down even from the mid-6 trillion won booked in the first quarter. Analysts say the picture improved meaningfully in the third quarter.

On October 1, industry sources said Samsung will release its preliminary third-quarter results after the Chuseok holiday. Data provider FnGuide pegs consensus at roughly 83 trillion won in revenue and 9-trillion-won operating profit, with several major brokerages projecting around 10 trillion won—suggesting upside to the street view.

Semiconductors are the main driver. DRAM prices have rebounded on a richer mix and rising server/AI demand, while NAND is improving as supply discipline and inventory drawdowns take hold. Foundry losses—estimated in the 2-trillion-won range in the second quarter—are expected to narrow below 1 trillion won in the third, helped by securing volumes from key clients such as Qualcomm and increased auto-chip orders.

The HBM (high-bandwidth memory) segment—previously a drag—also shows signs of recovery. With AI data-center demand holding up, industry estimates indicate third-quarter HBM shipments nearly doubled quarter-over-quarter. Market researcher TrendForce noted that DRAM suppliers’ focus on HBM and server DDR5 has tightened supply elsewhere, supporting a broader price rebound. Global DRAM module sales reached $13.3 billion in 2024, up 7% year-on-year, signaling a turn in the cycle.

Set businesses are also expected to hold up. New Galaxy Z Fold/Flip models should lift shipments and profitability, while display earnings likely benefited from higher shipments of foldable OLEDs and OLED panels for iPhone. By contrast, TVs and home appliances may face margin pressure amid sluggish global demand.

The medium-to-long-term outlook remains constructive. IBK Investment & Securities analyst Kim Un-ho expects the memory upcycle to extend as price gains broaden in the fourth quarter. Lee Su-rim of DS Investment & Securities forecasts that by 2026, faster DDR5 migration, HBM4 mass production and a server replacement cycle could push memory into a super-cycle.

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7