|

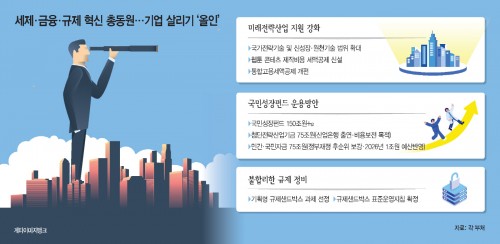

The government is launching an all-out policy package combining tax incentives, financial support, and regulatory innovation to bolster corporate growth amid slowing global demand, supply chain instability, and rising protectionism. The initiative aims to give Korean companies a stronger foundation to compete in next-generation industries such as semiconductors, batteries, and AI.

Tailored tax breaks for advanced industries

This year’s tax reform centers on “tax support for technology-driven growth,” with expanded credits for R&D and facility investment. For national strategic technologies like semiconductors and artificial intelligence—including generative AI and autonomous agents—small firms can deduct up to 50% of R&D expenses and large firms up to 40%. The government is also moving to designate AI data centers as strategic facilities to support large-scale infrastructure investment.

In addition, a new tax deduction for webtoon content production has been introduced: large and mid-sized firms may deduct 10% of labor and copyright costs, and SMEs 15%. Film and video production credits, previously set at 5–15%, will be extended for another three years, with the basic rate for large companies doubled from 5% to 10%. Officials expect these changes to ease production costs and strengthen global competitiveness in the content industry.

National Growth Fund expanded to 150 trillion won

The “National Growth Fund,” initially set at 100 trillion won, will now be expanded to over 150 trillion won over the next five years. The fund will target 10 high-tech strategic industries including AI, semiconductors, and biotech. Backed by both public and private financing, the fund will include 75 trillion won from the state-run Industrial Bank of Korea’s advanced industry fund, and 75 trillion won from private investors, citizens, and financial institutions.

Investment methods will range from equity stakes to infrastructure spending and ultra-low interest loans, supporting new startups, tech M&A, data centers, and industrial complexes. Some sub-funds will adopt a citizen-participation model to share returns. The Financial Services Commission views the fund as a cornerstone of a broader “financial transformation” designed to enhance industrial competitiveness, scale up venture firms, and generate regional growth and jobs.

Regulatory reform to accelerate innovation

Regulatory overhaul remains another pillar of the plan. To encourage new industries, the government is expanding the use of regulatory sandboxes, which allow emerging technologies and services to be tested without existing regulatory constraints.

In September, new sandbox projects were designated in AI, mobility, and biohealth, giving companies temporary exemptions to trial services. In April, the government finalized standardized guidelines to improve consistency and transparency in sandbox operations.

Jin Park, professor at KDI School of Public Policy and Management, assessed: “The administration’s policies on taxation and budgetary support are positive, but it’s too early to judge the results on regulatory reform.” He added, “Labor policy remains too skewed toward unionized workers. More measures are needed for non-unionized employees who lack protection.”

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7