|

Hyundai Motor and Kia are bracing for a sharp earnings decline in the third quarter as the prolonged U.S.–Korea tariff standoff weighs heavily on Korea’s auto industry. Analysts warn that the 25 percent tariff on vehicles exported to the U.S. could slash the two companies’ combined annual operating profit by more than 6 trillion won.

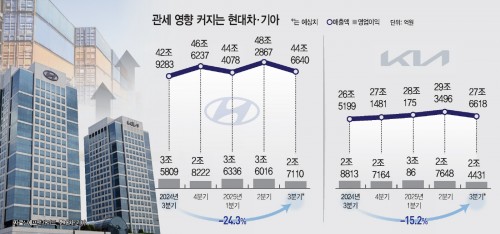

According to financial data provider FnGuide on September 24, Hyundai’s Q3 operating profit is projected at 2.71 trillion won, down 24.3 percent from a year earlier. Kia is expected to report 2.44 trillion won, a 15.2 percent drop. Their combined profit is estimated at 5.15 trillion won, about 1.3 trillion won less than last year. While revenues are set to rise — Hyundai up 4 percent to 44.66 trillion won and Kia up 4.3 percent to 27.66 trillion won — profitability has deteriorated due to tariff costs.

The impact became evident in Q2, when Hyundai and Kia booked operating losses of 828.2 billion won and 786 billion won, respectively, directly tied to tariffs. Brokerages forecast that if the 25 percent levy persists, the two automakers could see annual operating profits shrink by as much as 6.3 trillion won.

At Hyundai’s recent Investor Day, President José Muñoz admitted that “current margins are lower because of the 25 percent tariff,” adding that a reduction to 15 percent would make it easier to meet guidance. The company slightly raised its annual revenue growth target but trimmed its operating margin outlook to 6–7 percent, down from 7–8 percent.

Hyundai’s short-term strategy is to absorb tariff shocks through sales mix optimization and market share gains rather than raising prices. Longer term, the group plans to expand U.S. local production, ramping up operations at its Metaplant America facility in Georgia. Hyundai aims for over 80 percent of its U.S. sales to come from local production by 2030.

Kia, which has set a target of selling 4.19 million vehicles by 2030, is also focusing on flexible global market responses. Both companies are seeking to rebalance their portfolios, with Hyundai slightly lowering its projected North American sales share from 29 to 26 percent, while boosting exposure in China and Asia-Pacific markets.

Experts warn that the stakes are high not only for the automakers but also for Korea’s broader automotive ecosystem. Kim Pil-soo, a professor of future automotive studies at Daelim University, stressed, “Tariffs are the government’s responsibility, not companies’. If the auto ecosystem collapses, it will be difficult to recover. The government must quickly conclude follow-up negotiations and consider emergency support for automakers and suppliers.”

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7