|

SK Hynix is expected to further solidify its dominance in the high-bandwidth memory (HBM) market as its HBM3E 12-layer product is set to be fully adopted in NVIDIA’s next-generation AI GPU, the GB300, which is scheduled for release in the third quarter of this year. This development is also likely to positively impact the company’s earnings in the second half of 2025.

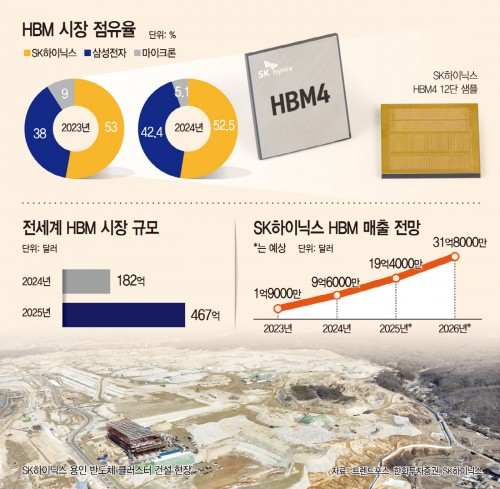

According to market research firm TrendForce on May 26, SK Hynix is projected to hold over 50% market share in the HBM4 segment—its sixth generation of HBM products—by 2026. Total HBM shipments this year are expected to exceed 30 billion GB, with HBM4 expected to become the market mainstream by the latter half of the year.

NVIDIA’s upcoming GB300 GPU, designed to maximize AI server performance, is expected to feature significantly enhanced computing power and memory bandwidth compared to its predecessor. As a result, SK Hynix is anticipated to be the biggest beneficiary of its launch.

SK Hynix has already secured a major portion of the HBM3E supply for the GB300. According to industry analysts, its HBM3E 12-layer variant accounts for more than half of all HBM shipments. As of Q1, SK Hynix commanded over 68% of the global HBM market, far ahead of its closest competitor, Samsung Electronics.

SK Hynix is also accelerating development of HBM4 using its 1b nanometer DRAM process. It may enter mass production as early as this year, with expectations to supply the memory for future NVIDIA GPUs and various AI edge devices. At Computex Taipei 2025, the company unveiled its HBM4 12-layer product and a roadmap for a 16-layer product scheduled for mass production in the first half of next year. NVIDIA CEO Jensen Huang reportedly praised the sample, calling it “truly beautiful,” and encouraged continued support for HBM4.

Ryu Young-ho, a researcher at NH Investment & Securities, noted, “As AI spreads from the cloud to edge computing, the memory market will grow in tandem. While short-term risks include reduced demand for legacy products and potential disruptions from global AI sanctions, there’s no doubt about AI’s long-term growth potential.”

However, recent moves by the U.S. Department of Commerce to increase tariffs on semiconductor equipment and components bound for China may pose challenges. Since SK Hynix has packaging facilities in China, any disruption in exports could impact the global supply chain. The company reportedly submitted a letter to the U.S. Bureau of Industry and Security (BIS) earlier this month, requesting protection from excessive tariffs and regulations.

Despite the uncertain market conditions, analysts believe SK Hynix will maintain its leadership in the HBM space. Son In-joon of Heungkuk Securities stated, “Although the outlook for legacy DRAM and NAND demand remains uncertain, SK Hynix’s high HBM market share and the ramp-up of AI GPU memory adoption will drive earnings growth.” Ryu Hyung-geun of Daishin Securities added, “Initial HBM4 revenues are expected in Q4 2025, and SK Hynix is likely to retain its leading position as the early market leader.”

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7