|

By AsiaToday reporter Bae Ji-yoon

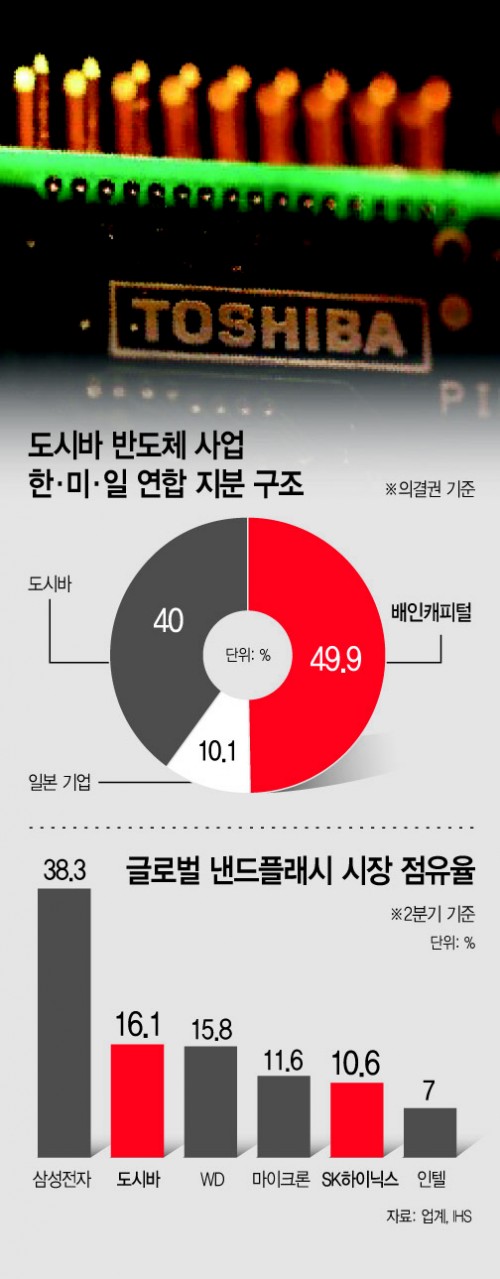

As an international consortium including Korea's SK Hynix succeeded in acquiring the memory chip business of the world's second largest NAND provider Toshiba, SK Hynix will be able to maintain its competitiveness in the NAND flash sector. Some point out that it may be difficult to get close to Toshiba's technology level right away, but many industry observers believe that the Korean chipmaker has successfully managed to defend NAND technology from passing on to Chinese companies.

Toshiba signed a deal with the South Korea-U.S.-Japan consortium to sell its NAND business on Wednesday. As a result, SK Hynix will be able to generate synergies with Toshiba, such as technical cooperation and customer connections. However, SK Hynix has not yet made an official announcement.

The latest research figures from market research firm HIS show that Samsung Electronics and Toshiba, which ranked first and second, accounted for 38.3% and 16.1% market share in the global NAND market in the second quarter, respectively. On the other hand, SK Hynix recorded a market share of 10.6%, placing fifth. Initially, SK Hynix rushed into Toshiba memory deal to strengthen its NAND technology.

SK Hynix has been somewhat weak in 3D NAND memory sector. It has been lacking technical expertise compared to Samsung Electronics, which is the leader in the 3D NAND market. However, the company will be able to expand its market share by teaming up with Toshiba.

NAND flash, a type of non-volatile memory that can retrieve stored information even after having been power cycled, is emerging as the golden goose of semiconductor industry. In fact, Samsung Electronics is boosting its 3D NAND flash production, leaving SK Hynix more impatient. In this market, Samsung, Intel and Toshiba are fiercely competing.

An official from the semiconductor industry said, "SK Hynix is relatively weak in the NAND market, compared to the DRAM market. While it remains firmly in second spot in the DRAM market, it is settled for fifth place in the NAND market. Therefore, the signing of the contract between Toshiba and the South Korea-U.S.-Japan consortium will provide an opportunity for SK Hynix to rebound through cooperation with Toshiba."

At the same time, SK Hynix will delay the chase of Chinese companies in the NAND market. Initially, Toshiba and the Japanese government were concerned to hand over Toshiba's memory business to China and South Korea. However, Toshiba leaned toward the South Korea-U.S.-Japan consortium as the global consortium guaranteed to minimize SK Hynix' interference of management rights.

#SK Hynix #Toshiba memory

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7