|

| Gold and silver bars are displayed at a precious metals shop in Kuwait City on Jan. 12. / AFP·Yonhap |

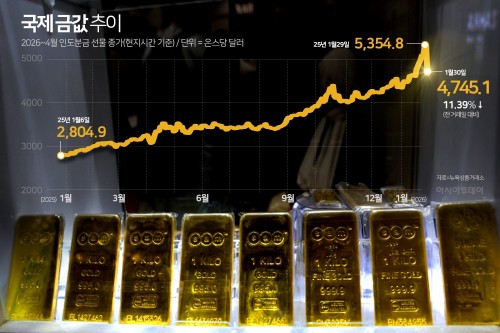

The global precious metals market has entered a correction phase following weeks of sharp gains, with silver prices suffering a historic collapse on Jan. 30.

Silver plunged by as much as $40 per ounce in less than 20 hours, marking a 26% crash — the largest single-day drop on record. Gold also fell 9% on the same day, its worst session in more than a decade, while copper, which had surged past $14,500 per ton amid speculative frenzy, abruptly reversed course. Bloomberg described the event as “one of the most dramatic collapses in commodity market history.”

Despite the sharp selloff, markets have yet to find relief. Analysts widely agree that the next direction of prices once again hinges on China.

According to charts from The Wall Street Journal and FactSet, silver futures surged more than 60% in just one month earlier this year, while gold rose over 20% — an unprecedented spike even compared to long-term trends since 2009.

Silver has historically spent very little time above $40 per ounce, but during this rally, prices skyrocketed vertically to near $120 per ounce by late January.

The immediate trigger that halted the parabolic rally was U.S. President Donald Trump’s announcement on Jan. 30 nominating former Federal Reserve governor Kevin Warsh as the next Fed chair. The announcement fueled a sharp rebound in the U.S. dollar, triggering a violent reversal in the already overheated precious metals market.

While warnings about excessive expansion had been mounting after weeks of gains, Bloomberg noted that the speed and magnitude of the decline shocked market participants.

Bloomberg identified Chinese speculative forces as the root cause of the collapse. From retail investors to large equity funds, Chinese “hot money” flooded into commodities, driving prices sharply higher.

Market participants described conditions as “parabolic,” “frenzied,” and even “untradeable.” Nicky Shiels, head of metals strategy at Geneva-based precious metals firm MKS PAMP SA, said January 2026 would go down as “the most volatile month in precious metals history.”

Speculation in silver reached unprecedented levels. On Jan. 30 alone, the world’s largest silver ETF, SLV, recorded over $41 billion in trading volume — exceeding the combined daily turnover of Apple and Amazon.

Just months earlier, SLV’s average daily volume stood at around $2 billion, highlighting the extreme speculative distortion gripping the market.

Both SLV and the world’s largest gold ETF, GLD, saw call option open interest hit record highs, creating dangerous squeeze conditions. During the rally, option buying forced dealers to purchase spot assets, pushing prices higher. However, once prices turned, the same structure accelerated mass liquidation.

Alexander Campbell, a former executive at Bridgewater Associates, explained, “That’s why it goes up so fast and comes down so fast. China sold, and now we’re living with the consequences.”

Following the dollar rebound, Chinese investors moved to take profits during the Asian trading session, triggering a rapid collapse.

The turmoil extended beyond financial markets into real industries. According to the Silver Institute, silver demand from the solar sector has surged since 2016, reaching levels comparable to jewelry demand last year, the WSJ reported.

Given that silver’s annual supply value is only about $98 billion, Bloomberg explained that structural demand growth combined with speculative inflows amplifies volatility.

The surge in silver prices directly squeezed margins for Chinese manufacturers, which produce 80% of the world’s solar cells. Silver’s share of production costs jumped from 5–7% to as much as 15–20%, pushing solar cell prices up to 5.47 cents per watt. China’s Tongwei Solar has warned of losses of up to $1.4 billion in its 2025 results.

Following the crash, market attention has once again shifted to China. Bloomberg reported that “what happens next may once again depend on China,” as investors closely watch whether domestic demand rebounds after the Shanghai market opens.

Chinese authorities and financial institutions have moved to curb speculation. China Construction Bank raised minimum deposit requirements, while Industrial and Commercial Bank of China imposed quota limits during the holiday period.

Additional measures were introduced to rein in risks tied to retail gold accumulation products, with regulators urging investors to remain aware of potential dangers.

A precious metals trader based in Shenzhen told Bloomberg that while bargain buying is emerging in gold, sentiment toward silver remains cautious.

Dominik Sproll, head of trading at Germany-based Heraeus Precious Metals, described the episode as “the roughest market of my career,” adding, “Gold is supposed to symbolize stability, and this movement does not.”

Bloomberg concluded that the crash was a textbook example of an overheated market collapsing as Chinese speculative inflows and expanded options leverage collided with a dollar rebound. Even after the plunge, however, market tensions remain unresolved.

For investors who joined the rally late, the collapse delivered a “painful” lesson. And with the next move still dependent on China’s choices, uncertainty in the precious metals market is far from over.

#gold #silver #precious metals #silver ETF #SLV

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7