|

South Korea’s major banks have raised mortgage rates back into the 6% range for the first time in two years, signaling a tightening lending environment as expectations for near-term rate cuts fade in both Seoul and Washington.

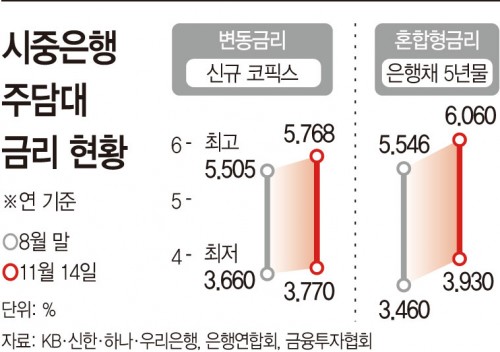

According to financial industry data on November 16, fixed-rate mortgage products at the four major banks—KB Kookmin, Shinhan, Hana, and Woori—stood at 3.930% to 6.060% as of November 14. It marks the first time since December 2023 that mixed (fixed) mortgage rates exceeded 6%. Compared with late August, the lower bound rose by 0.47 percentage points and the upper bound by 0.514 points.

The spike reflects a sharp rise in the benchmark five-year bank bond yield, which climbed from 2.836% to 3.399% over the same period—a surge of 0.563 percentage points. Rates on unsecured personal loans also jumped as the one-year bank bond yield, used as their benchmark, gained 0.338 percentage points. As a result, top-grade one-year personal loan rates rose from 3.520–4.990% to 3.790–5.250%.

Variable-rate mortgages linked to the newly originated COFIX index also edged higher. While COFIX itself rose only 0.01 percentage points, banks tightened loan screening amid real estate uncertainty and stricter household lending rules, effectively pushing borrowing costs higher.

The broader backdrop is a renewed sense of caution from both the Bank of Korea and the U.S. Federal Reserve, which have signaled the possibility of pausing rate cuts—or even raising rates again—depending on economic data. After BOK Governor Rhee Chang-yong noted on November 12 that the size, timing, and direction of future cuts would “depend entirely on new data,” government bond yields surged to their highest levels of the year across all maturities except the one-year tenor.

Real estate instability and heightened FX volatility further cloud the outlook, suggesting that upward pressure on lending rates may persist. With the BOK’s next rate decision uncertain, banks are beginning to adjust their products accordingly.

KB Kookmin Bank is set to raise its fixed and mixed mortgage rates by an additional 0.09 percentage points starting November 17, in line with recent increases in five-year bank bond yields.

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7