|

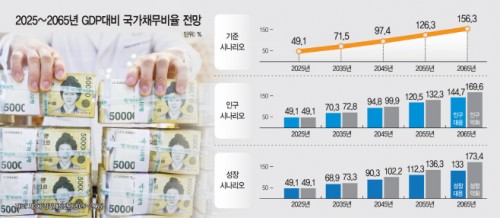

| The Ministry of Economy and Finance projects South Korea’s debt-to-GDP ratio will exceed 150 percent by 2065, citing low birthrates and an aging population. / Source: File photo |

South Korea’s national debt is projected to soar past 150 percent of GDP by 2065, raising fresh alarms over fiscal sustainability amid accelerating population decline and aging.

The Ministry of Economy and Finance on Wednesday released its “Third Long-Term Fiscal Outlook (2025–2065),” which forecasts the debt-to-GDP ratio at 156.3 percent in 2065 under the baseline scenario, more than triple this year’s 49.1 percent. Depending on population and growth assumptions, the ratio could range between 133.0 and 173.4 percent. The ministry cautioned that the report was not a precise prediction but a warning of fiscal risks if structural reforms are delayed.

The chief driver is demographic change. By 2065, the elderly will account for 46.6 percent of the population, more than double today’s 20.3 percent, while the working-age population shrinks by half. Rising pension and healthcare costs will push mandatory spending from 13.7 percent of GDP in 2025 to 23.3 percent by 2065.

Public insurance schemes are also at risk. The National Pension is projected to run a deficit by 2048 and deplete its reserves by 2064. The private school pension could turn red in 2026 and exhaust funds by 2047. The health insurance system is expected to face deficits from 2026 and run out of reserves by 2033. Civil service and military pensions will each post growing deficits equivalent to 0.69 percent and 0.15 percent of GDP by 2065.

Persistent debt accumulation could undermine economic resilience by weakening policy flexibility, triggering sovereign credit downgrades, driving up borrowing costs, and fueling capital flight. Future generations could also face a heavier tax burden, exacerbating intergenerational inequality.

Still, the trajectory could be moderated with strong fiscal reforms. If discretionary spending is cut by 15 percent, the debt ratio could drop to 138.6 percent. Curbing mandatory outlays could bring it down further to 105.4 percent.

The government outlined four strategies to enhance fiscal sustainability: boosting growth, broadening revenue, controlling expenditures, and reforming social insurance. Plans include promoting AI-driven innovation, restructuring low-performing or overlapping programs, tightening tax exemptions and evasion, and pursuing pension and health insurance reforms to cope with the aging trend.

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7