|

| A screen at the New York Stock Exchange (NYSE) shows Federal Reserve Chair Jerome Powell’s press conference after the FOMC meeting on June 18, where the Fed announced it would hold the benchmark interest rate at 4.25–4.50%. / Source: EPA-Yonhap News |

The U.S. Federal Reserve decided on June 18 to leave its benchmark interest rate unchanged at 4.25–4.50%, marking its fourth consecutive hold this year. The decision was unanimously approved by all 12 members of the Federal Open Market Committee (FOMC) following a two-day meeting.

“The economy continues to expand at a solid pace. The unemployment rate remains low, and labor market conditions are strong. Inflation, however, is still somewhat elevated,” the FOMC said in a statement explaining the decision.

Despite public pressure from President Donald Trump—who took office on January 20 and repeatedly called for rate cuts—the Fed has stood firm. Since cutting rates by a full percentage point across three meetings last fall, the Fed has now held rates steady in all four FOMC meetings this year: on January 29, March 19, May 7, and now June 18.

With this move, the interest rate gap between the U.S. and South Korea (currently at 2.50%) remains at 2.00 percentage points at the upper bound.

|

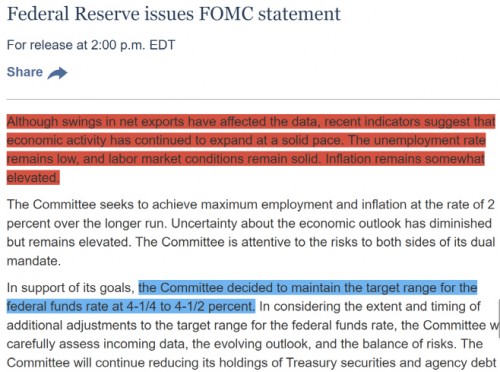

| A part of the Fed’s official statement released after the FOMC meeting on June 18, announcing its decision to maintain the benchmark interest rate at 4.25–4.50%. / Source: Federal Reserve |

While May’s consumer price index (CPI) rose 2.4% year-on-year and wholesale prices climbed only 0.1% month-on-month, the Fed remains cautious. Retail sales in May fell 0.9% from the previous month, indicating early signs of economic slowing in real-sector data.

The FOMC said it would carefully assess new data, evolving forecasts, and risks before considering any future rate changes.

In a press conference following the decision, Fed Chair Jerome Powell reaffirmed the central bank's cautious stance, stating it would wait for clearer developments in the economy before adjusting policy.

|

| Federal Reserve Chair Jerome Powell speaks during a press conference at Fed headquarters in Washington, D.C., on June 18 following the two-day FOMC meeting. / Source: EPA-Yonhap News |

“Uncertainty surrounding trade tariffs has eased somewhat, but remains elevated,” Powell said. “Tariffs are expected to place upward pressure on prices and weigh on economic activity.”

Powell emphasized the Fed’s readiness to pause and observe. “We’re in a good position to wait and gather more information on how the economy unfolds before considering any adjustments to the policy rate.”

He noted that the inflationary impact of tariffs may become more evident in the coming months. “Someone has to pay for tariffs,” Powell said. “So we expect meaningful inflation to emerge due to tariffs in the near term.”

Fed officials also released updated economic projections. They maintained their forecast of two rate cuts by the end of the year—unchanged from their March projections and consistent with their December 2024 outlook.

“Each participant has laid out their individual assessment of the most likely scenario for the policy path,” Powell said. “But no one is expressing strong certainty about the future trajectory of rates.”

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7