|

By AsiaToday Special Coverage Team

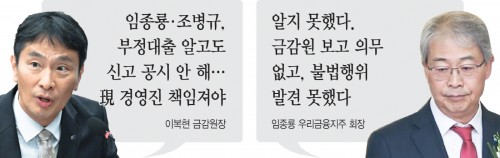

Lee Bok-hyun, the head of the Financial Supervisory Service (FSS), has strongly criticized Yim Jong-yong, the chairman of Woori Financial Group for failing to report and disclose information regarding inappropriate loans linked to the family of former Chairman Son Tae-seung. The FSS inspection revealed that Woori Bank was aware of criminal allegations and the related facts. As a result, severe punishment for the current management is expected, including Chairman Yim and Woori Bank President Cho Byung-kyu.

“The bank’s related department reported the fraudulent loans to the bank’s management last year, and the holding company management became aware of it in March this year,” the FSS stated on Sunday, confirming that the management did not report or disclose information regarding the improper loans to the supervisory authorities or the board.

The FSS is raising three main things: first, the bank’s management was aware about the fraudulent loans since September last year but did not report it to the FSS; second, they did not inform the board; and third, they initially reported it to the FSS as a ‘negligence in loan review’ and later reported it to the investigative authorities as a ‘financial accident,’ providing false explanations. The FSS believes that the current management intentionally did not inform the FSS and falsely claimed to the media that they were unaware of the fraudulent loans. In fact, Woori Bank and Woori Financial Group did not inform the board about the loans until June, just before the FSS investigation. Given that inappropriate loans were given during the terms of Chairman Yim and President Cho, and they did not report it to the supervisory authorities despite knowing about the financial accident, there is a possibility of embezzlement charges.

Furthermore, Lee believes that Woori Bank’s handling of the fraudulent loans has disrupted the financial order of the entire financial sector. The situation directly contradicts the efforts Lee has made to improve governance, such as enhancing the independence of the board and strengthening the role of management oversight.

“I don’t understand why Woori Bank is only now disclosing the financial accident,” a senior FSS official said. “The FSS has emphasized management oversight during board meetings since last year, but Woori Financial Group has not taken this seriously.”

Woori Bank posted about the “financial accident” on its website last Friday. According to the Banking Act, if there are criminal charges such as embezzlement or breach of trust involving employees, the FSS must be notified within 15 days of the occurrence of the financial accident. However, Woori Bank disclosed it 11 months after recognizing it in September last year. Lee hinted at the possibility of imposing the highest level of sanctions within the legal authority on Woori Financial Group and holding the current management accountable.

#FSS #Woori Financial #loan

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7