|

AsiaToday reporter Hong Sun-mi

Concerns over payment delays by WeMakePrice and TMON, South Korean affiliates of Singapore-based e-commerce giant Qoo10 Group, have been growing, causing suspensions of product sales and refunds to customers. Industry experts estimate the damages from the delay in payments would amount to over 100 billion won, or around 72 million U.S. dollars.

According to the e-commerce industry sources on Wednesday, Qoo10 Group’s liquidity shortages are rapidly affecting some of the group’s subsidiaries. The group’s overseas sales settlement was not paid last month, and settlement delays have occurred at WeMakePrice and TMON since early this month. While WeMakePrice and TMON are suffering delays in payments and refunds, other affiliated companies, AK Mall and Interpark are operating normally.

With the latest delay, sellers on TMON and WeMakePrice, including travel agencies, department stores and home shopping companies, are starting to suspend sales of their products on the platforms. Customers who have purchased flight tickets, hotels and tour packages through the two platforms are now receiving notices for cancellations or requests for repayments from travel agencies.

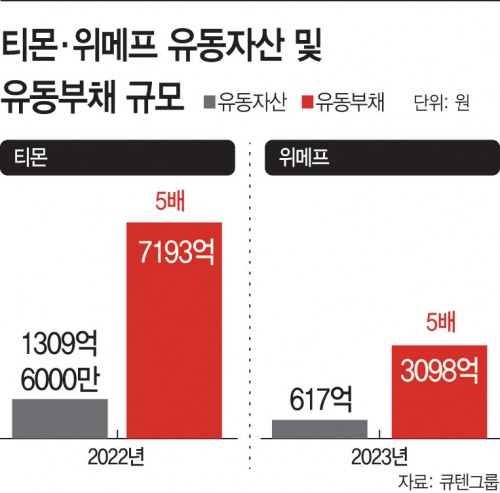

Market observers say that the situation will worsen because the capital of both TMON and WeMakePrice has remained impaired by mounting losses. TMON has already been in a state of capital erosion since 2017. As of 2022, it had current liabilities of 719.3 billion won while its current assets totaled only 130.9 billion won.

As of the end of last year, WeMakePrice’s current liabilities amounted to 309.8 billion won, which is five times larger than its current assets of 61.7 billion. To make matters worse, major commercial banks, including KB Kookmin Bank and Standard Chartered Bank Korea, have also decided to suspend the advance settlement lending to these platforms.

Meanwhile, an official at the presidential office told reporters that the office is keeping an eye on the situation regarding the retailers to ensure that consumers are not adversely affected.

#TMON #WeMakePrice #Qoo10 Group

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7