|

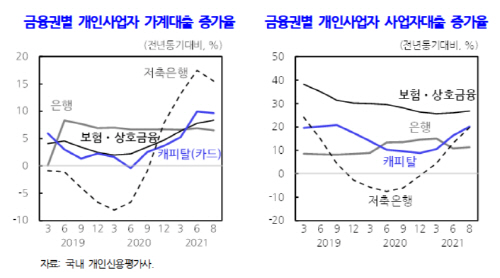

| Growth rate of individual business operators’ loans by financial sector/ Source: Korea Development Institute (KDI) |

AsiaToday reporter Son Cha-min

As the difficulties of the self-employed have been prolonged due to the pandemic and the quarantine measures, the debt of individual businesses has risen sharply, a report showed. The state-run research institute Korea Development Institute (KDI) has warned of a sharp increase in high-interest loans, especially among the self-employed. It is said that there is a possibility that self-employed loans may become insolvent ahead of the base rate hike, stricter household loan regulations, and the end of the deferral of principal and interest repayment.

KDI issued the report entitled “The risk diagnosis of self-employed debt and policy direction” on Tuesday.

According to the institute, the total balance of individual business loans stood at 988.5 trillion won as of the end of August, with business loans of 572.6 trillion won and household loans of 415.9 trillion won. This is a 21.3 percent increase compared to the figure of the end of December 2019, before the pandemic, which is 1.6 times higher than the 13.1 percent increase in general household loans during the same period.

In particular, KDI warned that the debt structure of the self-employed is worsening, noting that the loans of the self-employed are increasing rapidly in high-interest-rate businesses rather than in banks.

Household loans held by individual business owners have increased significantly since the first quarter of this year in high-interest-rate businesses such as savings banks, card and capital companies. Business loans also seemed to increase due to the influence of policy funds last year, but fell in the first quarter of this year. On the other hand, business loans from high-interest-rate businesses have risen sharply since the first quarter of this year.

“The self-employed have financed their business and living expenses through loans. Recently, dependence on high-interest loans has intensified, and the credit risk of affected companies has increased in both quantitative and qualitative terms,” KDI said.

“If interest rates are further raised and regulations on the debt service ratio (DSR) of banks are strengthened, the interest burden of the self-employed who are suffering from a lack of funds due to the pandemic may increase, so policy support is required,” it said.

KDI said that policy financing to the self-employed had a positive effect in preventing business shutdown and increasing sales and employment. However, it added that companies which went out of business immediately after receiving the government subsidy saw worsening of individual credibility.

It advised that a replacement product that replaces high-interest loans with low-interest long-term repayments should be provided to damaged enterprises, who are able to repay normally once their debt structure is improved, in order to lower their interest burden and risk of insolvency.

It also urged the need for financial support for self-employed people, who have suffered indirectly from the government’s quarantine measures, so that their credit do not deteriorate by using high-interest loans.

#high interest loan #self-employed #KDI

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7