|

By AsiaToday reporter Im Cho-rong

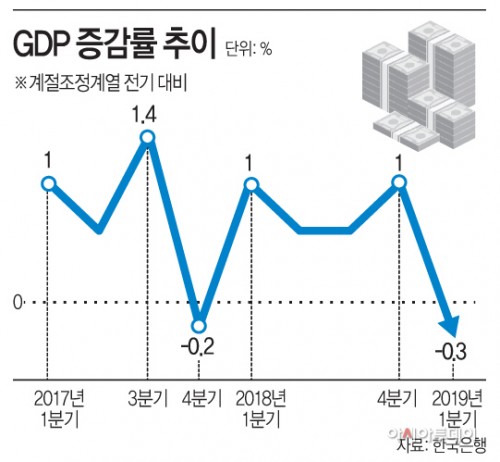

South Korea’s first-quarter GDP shrank 0.3 percent from the previous quarter, the first decline in five quarters and the biggest contraction since the 2008 global financial crisis. This is largely due to slowing capital investments and domestic demand as well as a sharp drop in exports. The high “base effect” worsened the numbers as government spending, which used to prop up the national economy, has been delayed.

However, the government believes overall GDP growth for 2019 will reach the central bank’s estimate of 2.5 percent once the delayed state contributions increase, including from an extra budget. The Bank of Korea (BOK) predicted that growth will rebound in the second quarter when the supplementary budget is provided.

The BOK announced the decline on Thursday – a fall of 0.3 percent from the previous quarter – the worst quarter-on-quarter figure since the fourth quarter of 2008 when the economy fell 3.3 percent. The country’s GDP added 1.8 percent on year, however it was the lowest since the 0.9 percent gain in the third quarter of 2009.

In order to reach 2.5 percent for full 2019, the country’s GDP should grow by 1.5 percent in the second quarter and more than 0.8 and 0.9 percent in the third and fourth quarter, respectively. Previously, the central bank forecasted overall GDP growth for 2019 to be 2.5 percent.

The sluggish first-quarter growth was mainly due to delayed government spending and falling exports, led by semiconductors. Domestic demand, including facility investment, is weak as well. “Despite the rate of executions of the budget at the central-government level is the highest in five years, the execution of SOC projects in the first quarter was sluggish because the procedure takes a lot of time,” said Park Yang-soo, director-general of the BOK’s economic statistics bureau. “The high base effect worsened the figures as high government spending in the fourth quarter of last year made this year’s first quarter figures look worse.” In the previous quarter, the government contributed to GDP growth by 1.2 percentage points. This time, state investments fell dramatically, dragging down the overall GDP growth rate by 0.7 percent.

Facility investment plunged 10.8 percent, the worst fall since the first quarter of 1998 in the wake of the Asian financial crisis. It was due to sluggish investments in both machinery and transportation equipment, including equipment for semiconductor manufacturing. Investments in imported transportation equipment declined as environmental regulations blocked foreign vehicle imports. The government’s concentrated expenditure on military equipment in the fourth quarter of last year also contributed to the decline.

Private consumption increased 0.1 percent. Due to the warmer winter, spending in medical services and clothing declined and delayed supply of SUVs due to Hyundai Motor’s labor-management negotiations also had a negative impact on private consumption.

Exports dropped by 2.6 percent on weak shipments of electrical and electronic devices such as LCD panels. Imports fell 3.3 percent on a decline in imports of energy goods, including crude oil and natural gas, and machinery and equipment.

Meanwhile, the real gross domestic income (GDI) grew only 0.2 percent on quarter.

#economy #GDP #Q1 #Bank of Korea

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7