|

AsiaToday reporter Lee Jae-ah

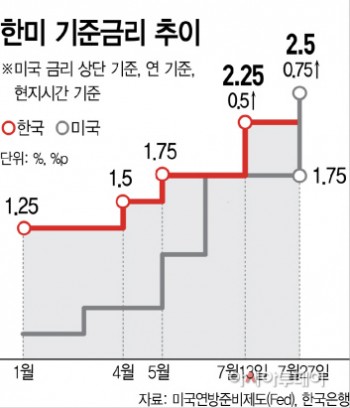

U.S. Federal Reserve has taken another ‘giant step’ on Wednesday, pushing the U.S. interest rates above South Korea’s benchmark interest rates for the first time in two and a half years. Due to the deepening inflation concerns and the reversal of interest rates between the two countries, the Bank of Korea (BOK) is highly likely to raise the base rate toward 3% by the end of this year.

After a meeting of the Federal Open Market Committee (FOMC), the Fed said that it raised its benchmark interest rate by 0.75 percentage points. The new target range is 2.25 percent to 2.5 percent, higher than South Korea’s 2.25 percent. It marks the first time since February 2020 that the U.S. interest rate exceeds South Korea’s.

Concerns about capital outflows are growing as investors tend to chase higher returns. Foreign investors have less reason to put money in South Korea, where interest rates are lower.

However, in the previous three cases where the U.S. interest rates exceeded Korea’s, there was no evident capital outflows. Rather, foreign securities were net inflows. In addition to the interest rate gap, foreign securities funds are affected by various factors, such as domestic and foreign financial and economic conditions and exchange rate forecasts.

The market predicts that the BOK will continue to raise the Korean benchmark interest rate at the three remaining Monetary Policy Committee meetings this year to reach 2.75 to 3.0 percent by the end of the year. This is because it is difficult for ease inflation amid the reversal of interest rates between the two countries.

However, many believe that the central bank is unlikely to take a ‘big step’ at a meeting next month since it is difficult to raise the base interest rate significantly in a row for reasons of price control. European investment bank BNP Paribas expected that the BOK would raise the interest rate twice more in August and October by 0.25 percentage points each, setting the final interest rate to 2.75 percent.

Meanwhile, Finance Minister Choo Kyung-ho held a meeting with Bank of Korea Governor Rhee Chang-yong and heads of the country’s financial regulators to discuss the reversal of interest rates between the two countries.

The government said the Fed’s latest rate hike is expected to have a limited impact on the domestic financial market as the outcome is in line with market expectations. However, it said that it will closely monitor the situation and expand preemptive measures.

#Fed #interest rate #reverse

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7