|

| Source: Statistics Korea |

AsiaToday reporter Lee Ji-hoon

South Korea’s consumer prices rose more than two percent for the fourth consecutive month in July, affecting people’s everyday life. The price of agricultural, livestock and fisheries products as well as oil prices are soaring. The government predicted that the prices would be stable in the second half of the year, but the reality is not optimistic. Above all, inflationary pressure is expected to rise further in the second half of the year if consumer sentiment improves due to expanded COVID-19 vaccination program and the government’s large-scale consumption stimulus measures.

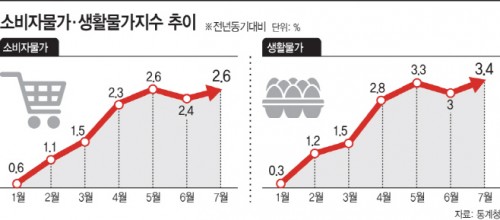

According to Statistics Korea on Monday, the consumer prices rose 2.6 percent on-year in July, surpassing the central bank’s inflation target of 2 percent for four consecutive months.

Such increase in prices is being highly driven by market basket prices. Due to poor harvests and the aftermath of bird flu outbreaks, the price of agricultural, livestock and fisheries products rose 9.6 percent on-year, raising overall prices by 0.76 percentage points. It has already risen 12.6 percent in the first half of the year, the biggest increase in 30 years, but the upward trend seems to continue.

Prices of eggs jumped 57 percent, the highest increase since July 2017 with 64.8 percent. In addition, prices of apples, pears, garlic, red pepper powder, pork and domestic beef also jumped. As a result, prices of daily necessities rose 3.4 percent on-year, the fastest gain in nearly four years.

At the same time, rising international oil prices are also fueling inflation. Prices of Dubai crude, which accounts the most imported from South Korea, was at $52.49 a barrel as of January 4, but rose to $70.72 a barrel as of August 6, according to Opinet, the oil price information provider under the Korea National Oil Corporation. As a result, oil prices in July jumped 19.7 percent on-year, raising the total price by 0.76 percentage points. In the aftermath of this, prices of gasoline at gas stations nationwide continued to rise for the 13th consecutive week.

As inflation continues, the government appears to be perplexed. Earlier, the government had said inflation would likely slow going forward due to the fading base effect, when announcing the consumer price trend in June. However, as the rise in prices continued in July, it changed its stance, saying, “There are upside risks to inflation as weather conditions could worsen and oil prices may further rise. Uncertainty from spiking COVID-19 cases also remains high.”

The government voiced extra vigilance against the possibility that upward pressure in consumer prices could build up in the coming months, and said it would focus on stabilizing prices. However, it remains to be seen whether the price flow would go as it desired. This is because there are factors that could encourage inflation, including the expansion of vaccination program and the payment of disaster relief payments.

“Inflationary pressure may grow more than expected as economic activity normalizes,” the Bank of Korea (BOK) said in its recently released report. “If the country fails to retrieve the increased liquidity at an appropriate time, this could trigger inflation as liquidity drives expansion in pent-up demand,” the report said. This means that if consumer sentiment revives with herd immunity achieved in the second half of the year and the cash flow in the market increases due to the disaster relief payments, the sentiment of retaliatory consumption, which has been suppressed for a while, can explode and even spur inflation.

#inflation #consumer price

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7