|

AsiaToday reporter Lee Ji-hoon

“Due to active fiscal management recently, South Korea’s fiscal deficit has surged and the national debt has increased rapidly,” said the state think tank Korea Development Institute (KDI) in its economic outlook released last Thursday.

South Korea’s central and local government debts called D1 is expected to reach 965.9 trillion won this year. The debt increases even more if general government debt called D2 is included. Concerns over the country’s fiscal soundness is mounting as the country is spending more to counter the economic fallout of the COVID-19 pandemic.

The Moon Jae-in administration has been maintaining an expansionary fiscal policy. It aimed to revive the economy through active fiscal inputs and create a virtuous cycle structure by broadening the taxation base.

But the reality was a lot more complex. The fiscal deficit has increased as the amount of money to spend increased amid the economic recession and drop in revenue due to expansion of tax support.

The Ministry of Economy and Finance announced Monday that the country’s consolidated fiscal balance posted a deficit of 71.2 trillion won last year, an increase of 59.2 trillion won from a year ago, amid efforts to overcome the pandemic. Excluding social security funds, the fiscal account registered a deficit of 112 trillion won, deficits rising 57.5 trillion won compared with the previous year.

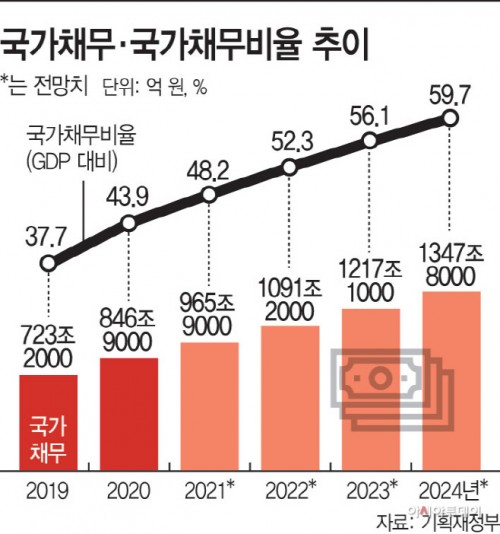

As a result, the national debt grew to a record 846.9 trillion won last year. With the latest extra budget of 14.9 trillion won, the national debt is expected to reach 965.9 trillion won this year.

During the same period, the debt-to-GDP ratio also surged. With the first extra budget, the ratio rose to 41.2% last year. Following the fourth supplementary budget, the debt-to-GDP ratio surged to 43.9%. This year, it is likely to reach 48.2%.

If another extra budget is set up, the national debt might surpass 1,000 trillion won this year, and the debt-to-GDP ratio may reach 50%.

The financial authorities are concerned about the rapid deterioration of the country’s fiscal soundness.

When organizing the first extra budget this year, Deputy Prime Minister Hong Nam-ki pointed out that South Korea’s government debt-to-GDP ratio would reach 50% in a couple of years at the current pace of increase although the figure itself is lower than the OECD average.

The bigger problem is that there are no signs of improving fiscal soundness near future. This is because the government is poised to keep its expansionary fiscal policy stance next year while hinting at another mega budget exceeding 600 trillion won. Besides, structural fiscal expenditures are expected to expand due to changes in the demographic structure.

Under the 2022 budget guidelines confirmed in March, the government is planning to propose a nation budget of over 600 trillion won next year to support the recovery of the coronavirus-hit economy.

Furthermore, the rapid increase in welfare budget expenditures due to rapid decrease in population and rapid aging as well as the increasing debt in the public sector are also raising concerns over the deterioration of fiscal soundness.

#S. Korea #fiscal soundness #fiscal deficit #national debt

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7