|

AsiaToday reporter Park Ji-eun

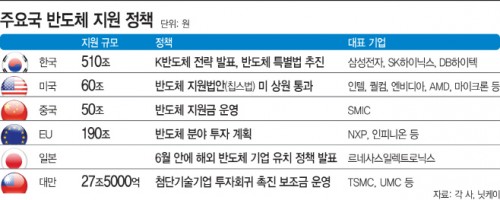

Major countries in the world are making aggressive moves to secure high-tech semiconductor production capacity. Following South Korea and Taiwan, the United States and the European Union (EU) announced astronomical subsidies for the semiconductor industry. The importance of securing semiconductor production base has been triggered by global supply shortage and a trade dispute between the US and China. Now, there is a growing consensus that if chips are not supplied in a timely manner, the economic security may be affected. This is why major countries are pouring out subsidies to attract semiconductor companies.

Following an approval of the US Innovation and Competition Act, the Semiconductors in America Coalition (SIAC) applauded the bill’s passage in a statement Wednesday, saying it is needed to “strengthen America’s economy, national security, global competitiveness, and technology leadership.” It said that investment in chip technology will benefit American workers, businesses, and consumers.

By a vote of 68 to 32, the U.S. Senate approved the bill, which includes about US$250 billion worth of spending for the development and production of key industrial technologies including semiconductors, amid escalating geopolitical and economic competition with China.

The key of the bill is providing support to the semiconductor industry. Of the $250 billion spending, $54 billion will be invested in the semiconductor sector. Over the next three years, the subsidy that chip companies can receive to build factories and research centers in the United States amounts to $39 billion. The U.S. promised tax benefits and support to those of its own companies comparable to the world’s leading semiconductor foundry companies, TSMC and Samsung Electronics. The U.S. will invest in water and power facilities, which are weak points of the country. “Senate passage of USICA is a pivotal step toward strengthening U.S. semiconductor production and innovation,” said John Neuffer, President and CEO of the Semiconductor Industry Association (SIA).

South Korea is moving to legislate its first special bill on the local chip industry, following its K-Semiconductor Strategy involving 510 trillion won. The key of the K-Semiconductor Strategy is the balanced growth of foundries and fabless companies. “I view positively the K-Semiconductor Strategy containing a plan to foster a fabless ecosystem,” said MagnaChip CEO Kim Young-joon. Besides, many demands from the industry have been reflected, such as tax deductions and training of 36,000 individuals.

The EU plans to invest €145 billion into digital technologies, including semiconductors, by 2023. Investment is expected to focus in connection with automobiles, such as autonomous driving and sensors. The industry observers believe that Intel and GlobalFoundries are highly likely to build foundry factories in the EU. Taiwan has been operating subsidy program to promote domestic investment by high-tech companies, including chip companies.

The Japanese government is scheduled to announce a policy to attract semiconductor companies, at the end of the month. Japan’s Ministry of Economy, Trade and Industry is reviewing to treat semiconductor industry growth as a national project, as important as securing food and energy. Some Japanese media outlets, including Nikkei and Asahi Shinmun, said Taiwan and South Korea have 5-nanometer technology to produce semiconductors while key Japanese automotive supplier Renesas Electronics can mass-produce only up to 40-nanometer chips. “Japan is only expected to grow more dependent on overseas supply without a major change,” they said.

#Semiconductor #SIAC #investment #South Korea #EU

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7