|

AsiaToday reporters Cho Eun-gook & Lee Joo-hyung

The role of financial companies is growing in the South Korean economy. It’s been 20 years since both Shinhan Financial Group and Woori Financial Group have been established. Hana Financial Group and KB Financial Group were established in 2005 and 2008, respectively. In 2012, NongHyup Financial Group was established. Woori Financial Group, which was disbanded in the course of privatization, was re-established in 2019, creating a structure of five leading financial groups in the country.

Many agree that the role of the financial groups in the South Korean financial history is indispensable. One of their greatest achievement was they raised the competitiveness of the financial industry by contributing significantly to the advancement of the financial industry. However, many still point out there is still a long way to go compared to global financial groups, such as Goldman Sachs and JP Morgan.

Besides, the opaque corporate governance is inhibiting the growth of financial groups and lowering credibility. Many believe the five major financial groups should enhance their financial and digital competitiveness and increase their credibility in order to leap forward as leading financial groups in the global market.

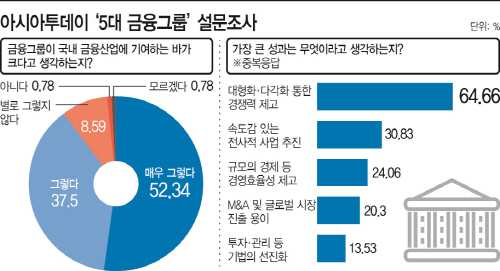

In celebration of the 20th anniversary of the financial groups’ inauguration, AsiaToday conducted a survey for two days from April 20 using Google’s survey service. Nearly 90% of respondents said the financial groups played a significant role in the growth of domestic financial industry, according to the survey. About 200 people, including employees of the five major financial groups as well as officials from the National Assembly, participated in the poll.

Most of respondents picked ‘enhanced competitiveness of the financial industry through enlargement and diversification’ (64.66%) as the biggest achievement of the financial groups, followed by ‘speedy business promotion’ (30.83%) and ‘improved financial efficiency’ (24.06%).

Financial groups have subsidiaries in most areas of finance, such as banks, securities, cards, insurance and capital, and operate in an integrated manner. Many points out that such enlargement and diversification strategy of the financial groups has contributed to enhancing their competitiveness and advancing the financial industry.

“Financial groups have integrated the functions of commercial banks, investment banks, insurance and securities companies, which were operated independently, enhancing flexibility and inclusiveness of financial services and even enhancing the competitiveness of the Korean financial industry as a result,” said Kim Young-han, a professor of economy at Sungkyunkwan University.

However, it has been found that there are also a number of problems caused by the financial groups. While they are actively engaged in M&As and overseas expansion, 50.38% of respondents pointed out that ‘excessive competition for performance’ is taking place in the process. Many also said the subsidiaries of the five major financial groups are offering standardized financial services while repeating the same problem of insufficient protection of financial consumers. The recent private equity crisis involving Lime and Optimus was caused by excessive performance competition. Besides, financial groups can exert synergy through collaboration between subsidiaries, but there are concerns that risks may be transferred at the same time.

The opaque corporate governance of the financial groups is pointed as a chronic problem. Many point out that the closed succession and the centralized authority on the financial group chairman may play as an obstacle to the sustainable growth of the financial groups.

#financial groups #Shinhan Financial Group #Woori Financial Group #AsiaToday

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7