|

By AsiaToday reporter Moon Noo-ri

About two years ago, Hanjin Shipping Co., at the time the world’s seventh largest container carrier, sought bankruptcy protection. Since then, surviving national shipping companies have begun to secure competitiveness. However, the gap in competitive power is widening between domestic and global shipping companies.

Twenty years ago, South Korea was a maritime powerhouse that competed with global shipping companies. At the time, Maersk was the largest container carrier in the world. However, the combined vessel capacity of Hanjin Shipping and Hyundai Merchant Marine had surpassed Maersk.

The landscape of the shipping industry changed after the collapse of Hanjin Shipping. South Korea is gradually losing its ground. The government is trying to revive the nation’s shipping and shipbuilding industry by supporting and establishing Korea Ocean Business Corporation (KOBC). However, the shipping industry remains in tough circumstances due to rising oil prices and falling freight rates.

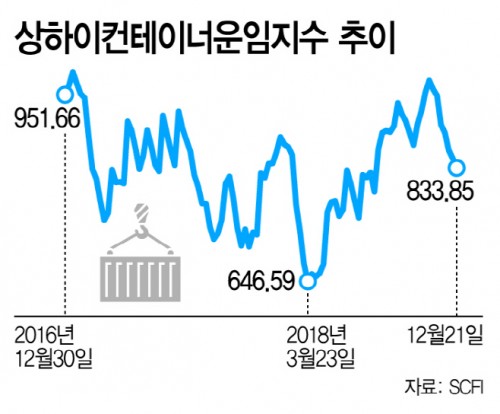

The ever-falling freight rate is a risk factor for the domestic shipping industry. According to the related industry on Thursday, Shanghai Containerized Freight Index (SCFI) on December 21 stood at 833.85, significantly lower than two years ago that stood at 951.66. The SCFI has been declining sharply since November 2, when it reached the highest point of 976.52.

Oil prices were not in favor of the nation’s shipping industry. As international oil prices jumped, many shipping companies had to face problems with profitability. For instance, bunker oil prices soared 30 percent from the same time last year. As a result, Hyundai Merchant Marine decided to apply additional surcharges to freight rates starting January next year.

On the other hand, global shipping companies are strengthening their presence in the market by increasing their size. European shipping companies are actively going out and doing mergers and acquisitions. Maersk bought north-south specialized carrier Hamburg Süd from Germany. This is one of its strategies to keep its top position in the global market. France’s shipping giant CMA-CGM acquired Singapore’s APL while Germany’s Hapag-Lloyd bought Gulf carrier United Arab Shipping Company (UASC). China’s COSCO purchased Orient Overseas (International) Limited (OOIL) of Hong Kong.

The oligopolistic structure is accelerating with continuous M&As among global carriers. The number of shipping carriers with over 1 million twenty-foot equivalent units (TEU) in total loading capacity increased to seven this year from four in 2016. On the other hand, the number of global carriers with handing capacity of over 200,000 TEU reduced from 18 in 2016 to only 12 now.

These global companies are growing bigger by absorbing Hanjin Shipping’s existing companies one by one. According to the Korea Maritime Institute (KMI), nearly 3 trillion won of domestic freight revenue has evaporated as foreign carriers took over most of Hanjin Shipping’s traffic.

#Hanjin Shipping #bankrupt #shipping industry #container carrier #Maersk

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7