|

By AsiaToday reporter Kim Bo-yeon

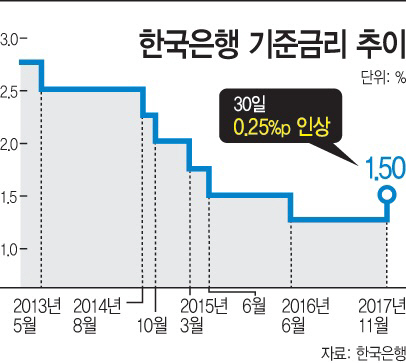

The era of ultra-low interest rates has come to an end. The Bank of Korea (BOK) has raised interest rates for the first time in more than six years, signaling the new era of higher interest rates.

The future rate increase is expected to come in a gradual manner. BOK Governor Lee Ju-yeol said that he would adjust the rate in a moderate manner, saying, "We will make careful decisions on the future rate-hike decision." Market observers expect interest rate will be raised one or two times next year.

The Bank of Korea's policymakers held a regular meeting on Thursday, and decided to increase the benchmark rate to 1.5 percent from a record-low of 1.25 percent.

The rapid recovery of the economy, driven by strong exports, encouraged a rate hike. The country's gross domestic product hit a seven-year high of 1.4 percent in the third quarter, and the annual growth rate is likely to reach 3% this year.

The fact that the U.S. Federal Reserve is widely expected to raise its rates next month has also affected South Korea's rate hike. As it can trigger capital outflows from South Korea with the reversal of the Korea-US interest rate, the BOK has seemingly taken a preemptive action.

Despite the government's regulations, mounting household debt is another reason for the BOK's move. The new government has been presenting real estate measures and loan regulations, the growth of household debt is not slowing down. Household debt increased by 31.2 trillion won (US$28.7 billion) from the previous quarter to 1,419.1 trillion won (US$1.3 trillion) during the third quarter of this year. The upward trend has not stopped at all considering that the debt increased in the first and second quarters by 16.1 trillion won (US$15.0 billion) and 28.8 trillion won (US$26.5 billion), respectively.

Now, the attention has been turned to how fast and frequent the rate hike will take place next year. Experts have been saying that the rate hike could be accelerated in light of the fast growing domestic economic growth, however the market has become silent with governor Lee's "gradual rate increase" remarks.

Krystal Tan, an economist at Capital Economics, said, "The BOK Governor Lee's remarks at the press conference showed that the BOK is not considering active money tightening. The rate increase is expected to come only once next year."

#interest rate #Bank of Korea #rate hike

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7