|

By AsiaToday reporter Kim Eun-young - Millennials are increasingly preparing for life after retirement.

According to a report by Wealthmanagement.com last month, Millennials started saving at a median age of 22. That compares to 35 for Baby Boomers. This may be reflecting Millennials' growing concerns about the future viability of social security and their intention to avoid working further into their retirement years or having to rely on their children for support as life expectancy has increased. An increased student debt burden associated with higher education and the cost of financial support for their families are among factors that may have encouraged early saving.

Singapore's Channel NewsAsia reported that 84% of young Singaporeans aged 25-35 years olds are concerned about their financial preparations for retirement, and 55% have started saving and planning actively for their future. In addition, 86% are willing to save S$300 (approx. KRW 250,000 ) a month to achieve S$1 million (approx. KRW 800 million won) by retirement.

Mr Edwin Ooi, a 27 year-old financial adviser in Singapore, is also planning ahead. Having dreamed of early retirement from his youth, he intends to stop working full-time by the age of 45 to spend his time more freely. He said, "I'm saving about 30% of my income on a monthly basis and that goes into various portfolios of investments." He added, "Retiring early would mean that I would have more time to spend with family and to do things that really matter in life."

Mr Edwin Ooi, a 27 year-old financial adviser in Singapore, is also planning ahead. Having dreamed of early retirement from his youth, he intends to stop working full-time by the age of 45 to spend his time more freely. He said, "I'm saving about 30% of my income on a monthly basis and that goes into various portfolios of investments." He added, "Retiring early would mean that I would have more time to spend with family and to do things that really matter in life."

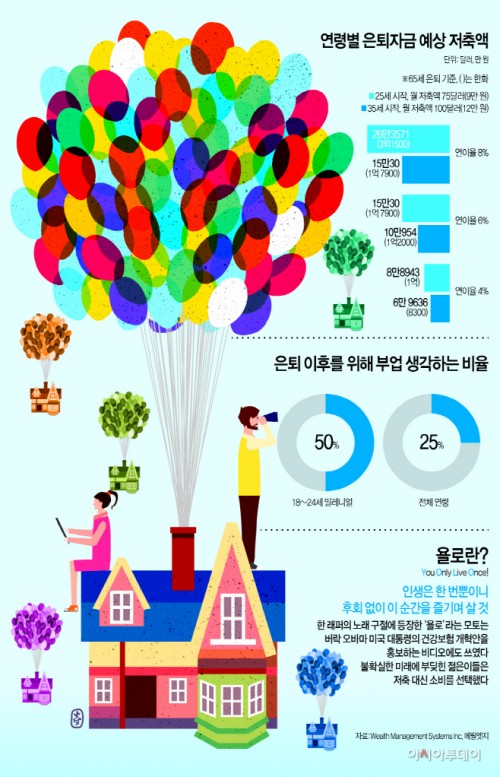

Some Millennials are working two jobs to help prepare for their future. A recent data by Merrill Edge, an American online wealth management service provider, showed that nearly half of Millennials aged 18-24 years olds believe they need to take on a side job to reach their retirement goals, compared to 25% of all respondents.

The Straits Times (ST) said that Millennials are increasingly moonlighting as online personal shoppers or drivers for car-hailing firms like Didi Chuxing in China by means of internet economy. Ms Zhao Xu, 27, has a full-time job as a property agent. To supplement her income, she sells cosmetics and medicines procured from Japan. In a good month, she can make up to 5,000 yuan, which is one third of her income from her full-time job.She explains that it's possible with a smartphone and WeChat, a mobile messaging platform. She said, "My company is aware of this, but I will make sure my bosses don't see the ads that I spend out during office hours. I still value my full-time job as an agent." Economist Hu Xingdou, said, "These new opportunites allow people to have something to fall back on, reducing the risk of not being able to eke out a living amid a slowing economy."

Bloomberg recently said that Japanese Millennials are worried about their life after retirement at their early ages and they are tightening their belts to save money for their future. According to Swiss financial company UBS, those 25-34 years old save a larger share of their earnings than any other age group in Japan in 2015. Besides, there are also those young Japanese who consider living abroad to improve the quality of life after retirement. Kohei Ito, 24, works in a fitness center after graduating from college. He is planning to move overseas to teach sports to children in developing countries. "I don't believe the government will fix problems such as unsustainable pension system," he said. "I don't think Japanese politics is going to get better, and I don't think the economy will get better either," he added.

With increased focus on professional financial guidance following the trend, those applications that help Millennials' asset management are emerging. Hong Kong startup 8 Securities recently launched a robo-investment advisor app called "Chloe." Powered by artificial intelligence and machine-learning technologies, the app effectively learns day by day as a system's user base and database grows. Once the savings goals and target date are set, the customer will be presented a selected exchange traded funds (ETFs) portfolio. In Singapore, there is a new application called FinGo, which enables you to view multiple bank accounts on a single screen. It was created based on the fact that many Millennials have two or three bank accounts each, and that multiple bank accounts could not always be viewed on a single portal at a glance. In addition, there's an American app Qapital, which allows you set up a number of triggers that helps you save automatically.

Financial industry experts say that the attitude toward retirement is changing among Millennials. "(Retirement) used to be working for a company for 20 to 30 years and then stopping, and that was it - you didn't work again," said Mr Mark Surgenor, Head of Wealth Sales at HSBC Singapore's Retail Banking and Wealth Management. "Now people are thinking in a much more active way about retirement." He added, "They are thinking about moving into retirement, by perhaps doing a bit less of their day job, and picking up some other work that's close to what they do, or something that's close to what they really enjoy. They might plan to do that for five to 15 years. Ultimately, they may eventually want to completely stop but it's much more of a phased approach now."

On the other hand, there is also a tendency among Millennials to concentrate on the present instead of preparing for their vague future as 'Yolo' (you only live once) has become a catch-all phrase for the generation. The UK daily Telegraph reported that Chinese Millennials rank travel more important than any other priorities listed, including buying a car or home, paying off debt, and savings, citing the recent study by market research agency GFK. The survey found that 93% of Chinese respondents considered travel an important part of their identity.

However, many experts recommend that you should begin your retirement preparations at an early age even if it's small amount. Zina Kumok, a writer specializing in personal finance, wrote a column entitled "Even Broke College Students Should Be Saving for Retirement" for the Time, where she stressed the importance of maximizing compound interest, "If John contributes $25 each month to a retirement account that earns 7% interest, he'll have $59,890.53 after 40 years. If he waits 10 years to start contributing, he'll have to save $52.50 each month to reach the same result after 30 years." For Millennials, the time to come is the greatest weapon.

#Millennials #retirement #yolo

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7